Reduced roth ira contribution calculator

Ad Contributing to a Traditional IRA Provides for Tax-Deferred Growth. Ad Help Determine Your IRA Contribution Limit With Our Tool.

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Less than 140000 single filer Less than 208000 joint filer Less than.

. Ad Learn About 2021 IRA Contribution Limits. Roth IRA Calculator. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

It is mainly intended for use by US. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Benjamin Curry - Forbes Advisor 5232022.

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Ad Learn About 2021 IRA Contribution Limits. Roth Ira Reduced Contribution Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the.

However this account is different from a traditional IRA because you contribute after-tax. Currently you can save 6000 a yearor 7000 if youre 50 or older. Roth IRA Reduced Contribution Calculator.

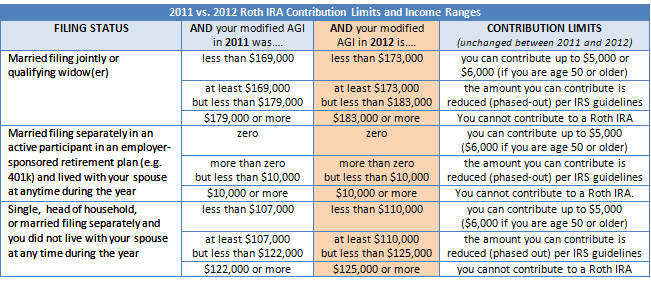

Many factors can affect your eligibility and contribution limits to either the Traditional IRA or Roth IRA tax filing status your current earned income level and whether or not you participate in a. Eligible individuals age 50 or older within a particular tax year can make an. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022.

Roth IRA Calculator Project how much your Roth IRA will provide you in retirement. Open A Roth IRA Today. Below is an example of how the reduced limit is calculated for someone who is filing as single head of household or.

Assuming youre not about to retire following year you want development as well as concentrated investments for your Roth IRA. As a rule you should plan not to make any withdrawals until at. Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3.

If youre single the maximum contribution is 5000 if youre younger than 50 or 6000 if youre 50 or older. So assuming youre not ready to retire next year you desire growth and also focused investments for your Roth IRA. If youre married your limit is.

You can adjust that contribution. Reduced Roth IRA Contribution Limit Calculator. A Traditional IRA Can Be an Effective Retirement Tool.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Annual IRA Contribution Limit. Traditional and Roth IRAs give you options for managing taxes on your retirement investments.

For 2020 Roth IRA contributions are reduced if income is between 124000 and 139000 and contributions are. You can contribute to a Roth IRA if your Adjusted Gross Income is. A Roth IRA is intended to be a retirement account so penalties apply if you misuse it by withdrawing funds too early.

Start with your modified 2021 AGI. Multiply the contribution limit by your reduction factor. Get The Freedom To Plan For Your Income Needs And Legacy Goals.

We Go Further Today To Help You Retire Tomorrow. Unlike taxable investment accounts you cant put an. Contributions are made with after-tax dollars.

Open A Roth IRA Today. Subtract the result in 4. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

A Roth IRA is also a retirement account that you open and fund yourself not through an employer. See the impact of employer contributions different rates of return and retirement age. Roth IRAs have income limits that prohibit higher earners from contributing.

We Go Further Today To Help You Retire Tomorrow. Roth individual retirement accounts IRAs are powerful tools for building tax-free savings in retirement. Invest With Schwab Today.

For comparison purposes Roth IRA and regular taxable. Unfortunately there are limits to how much you can save in an IRA. To put it simply you want.

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculator Roth Ira Contribution

What Is The Best Roth Ira Calculator District Capital Management

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

What Is The Best Roth Ira Calculator District Capital Management

Historical Roth Ira Contribution Limits Since The Beginning

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Contributing To Your Ira Start Early Know Your Limits Fidelity

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks